How AI Boosted Nvidia's Market Cap to $2T

From GPU developer to the most important AI company in one year

👋 Hey, I’m Stepan and welcome to a ✨ subscriber-only edition ✨ of Creators’ AI. By subscribing, you directly support Creators' AI's mission to deliver top AI insights & practical knowledge without ads or clutter. Your subscription allows us to grow our dedicated team and curate the most important AI Tools, Stories, and Tutorials in one place. - Stepan

Nvidia Now Synonymous for AI

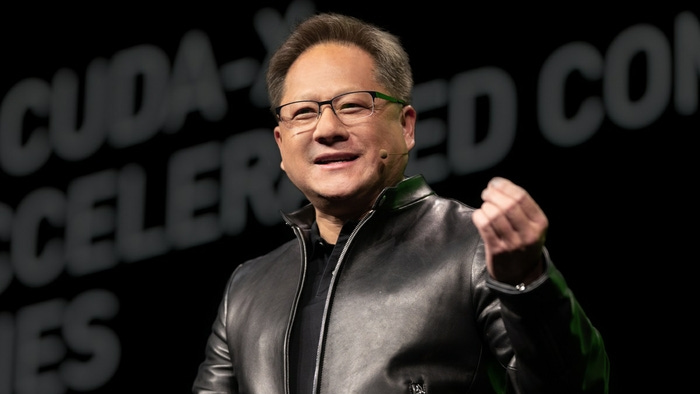

You don't have to go far to realize how in-demand Nvidia is for the AI industry. In one year, Jensen Huang’s company broke into the world's top three most valuable companies, surpassed Google and Amazon, and was named "the most important stock on planet Earth" by Goldman Sachs. Today, I propose to explain how this happened.

Let’s discuss Nvidia's recent history and how the company became a key AI supplier. Along the way, we'll decide whether Mr. Huang is worthy of the "the new Steve Jobs" title and whether the company's more than $2T market cap is an element of chance. (spoiler: both yes and no)

🔗 Are you already subscribed and want to ensure you don’t miss our newsletters? Move our newsletter from “Promotions” to “Primary” in your inbox! (video instructions below)

From $1T to $2T Market Cap In Less Than a Year

How we got to this point

Traditionally, we should have started at the founding. But we won't go back that far because the most exciting part of Nvidia's history has been in the last couple of years. It was also the period when Jensen Huang turned the company into a primary beneficiary of the AI industry.

And for those who haven't followed Nvidia before, I'll just remind you that it was launched as a startup specializing in graphics processor development in 1993, after which it grew steadily until it became a key player in this market. Its customers include Apple, Microsoft, Google, and many others.

While Nvidia has long been an extremely important company—for investors and tech companies alike—until a year ago, few would have suspected its stock would quadruple in value. But that all changed thanks to video games and tech stalemate.

Speaking during a keynote at SIGGRAPH in Los Angeles, Jensen Huang revealed that he made an existential business decision in 2018 (long before the boom of ChatGPT, Gemini, Perplexity, and many others). While improving its platform for video game developers, the company realized rasterization was reaching its limits.

Rasterization was one of the most popular 3D scene rendering methods at the time.

It has become almost impossible to make computer graphics more advanced. To solve the problem, Nvidia embraced AI-powered image processing through ray tracing and intelligent upscaling: RTX and DLSS. Huang said this idea required reinventing the hardware, software, and algorithms. It was a moment when the visionary thing worked even better than Huang thought it would.

So, the company created a next-generation GPU for improved graphics processing. And it worked. If you follow the gaming industry, you're well aware that one of the reasons for the stunning visuals in Cyberpunk 2077, Control, and Alan Wake 2 is precisely because of the support for these technologies.

Keep your mailbox updated with practical knowledge & key news from the AI industry!

That said, between 2018 and 2021, even Nvidia didn't realize what a treasure trove had been unearthed. And then it was luck's turn. Everything changed with the boom of machine learning. Users have only begun to familiarize themselves with the first models, while IT companies have turned to Nvidia to get GPUs to train new platforms.

If you are looking for a daily driver chatbot, our AI Benchmark will be very useful:

Specifically, Amazon, Google, Meta, Microsoft, OpenAI, and many others are in the front row of customers. Everyone wanted a GPU for AI from Nvidia. From that point on, things took off for the company (Well, it was growing anyway, but from that point on, Nvidia's growth became unstoppable). The market quickly noticed who was leading the charge, increasing the company's stock.

And what now?

Nvidia's influence on the IT industry is more visible than ever. According to industry analysts, the company controls 95% of the AI chip market. Nvidia supplies its GPUs to big tech and most unusual partners: factories, automakers, and even big pharma. And that's reflected very well in its financial performance.

When the company released its quarter report late last year, we discovered that its profits were up 588% and revenue was up 206%. The annual report did not disappoint either. After its publication, the market cap increased by $277B, the largest daily growth in Wall Street's history. Nvidia almost quadrupled in the last 12 months.

Just to give you an idea of the numbers we're talking about, actual Nvidia’s market cap is comparable to the annual GDP of countries like Italy, Brazil, and Canada.

That's how Nvidia took advantage of the situation. Given the huge demand (some Nvidia customers were willing to wait 11 months for their chips) and the lack of competitors, the company has priced its GPUs accordingly. The exact cost is not disclosed (apparently, it depends on the customer), but we know that Nvidia H100s were sold on Amazon for $40,000 per unit last year.

Creators’ AI could be a valuable gift for your friend, colleague, or family member. Gifting books is bright, but giving an AI newsletter is a superb move 😎